Recently financial applications attracted a significant interest

from the signal processing community since the global crises

demonstrated the importance of sound financial modeling and reliable

data processing. Financial markets produce vast amount of temporal

data ranging from stock prices to interest rates making them ideal

mediums to apply signal processing methods. Furthermore, due to the

integration of high performance, low-latency computing recourses and

financial data collection infrastructures, a wide range of signal

processing algorithms could be readily leveraged with full potential

in financial stock markets.

This project specifically focuses on the

portfolio selection problem, which is one the most important financial

applications and has already attracted substantial interest from the

signal processing community. In particular, we study

investment in a financial market having a finite number of assets. We

concentrate on how an investor should distribute capital over these

assets and when he/she should reallocate the distribution of the funds

over those assets in time to maximize the overall cumulative

wealth. In financial terms, distributing ones capital over various

assets is known as the portfolio management problem and reallocation

of this distribution by buying and selling stocks is referred as the

rebalancing of the given portfolio. Due to obvious reasons, the

portfolio management problem has been investigated in various

different fields from financial engineering, machine learning to

information theory, with a significant room for improvement as

the recent financial crises demonstrated. To this end, we investigate

the portfolio management problem in discrete-time markets when the

market levies proportional transaction costs in trading while buying

and selling stocks, which accurately models a wide range of real life

markets.

Sample publications on this topic include:

-- S. Tunc, M. A. Donmez and S. S. Kozat, ``Growth Optimal Portfolios in Discrete-time Markets Under Transactions Costs,'' IEEE Transactions on Signal Processing, 2013.

-- N. D. Vanli, S. Tunc and S. S. Kozat, ``Robust Portfolio Selection in Discrete-time Markets Under Transaction Costs,'' Digital Signal Processing, 2013.

-- S. Tunc, S. S. Kozat, ``Optimal Investment Under Transaction Costs: A Threshold Rebalanced Portfolio Approach,'' IEEE Transactions on Signal Processing, vol. 61, issue 12, pp. 3129-3142, June 2013.

-- M. A. Donmez, S. Tunc, S. S. Kozat, ``Optimal Portfolios Under Transaction Costs in Discrete Time Markets," Proceedings of IEEE Workshop on Machine Learning for Signal Processing Workshop, 2012.

-- M. A. Donmez, S. Tunc, S. S. Kozat, ``Growth Optimal Portfolios in Discrete Time Markets Under Transaction Costs," Proceedings of IEEE Conference on Signal Processing Advances in Wireless Communications, 2012.

-- S. S. Kozat, A. C. Singer, ``Switching Strategies for Sequential Decision Problems with Multiplicative Loss with Application to Portfolios," IEEE Transactions on Signal Processing, vol. 57, issue 6, pp. 2192-2208, 2009.

-- S. S. Kozat, A. C. Singer, A. J. Bean, ``A Tree-Weighting Approach to Sequential Decision Problems with Multiplicative Loss,'' Signal Processing, vol. 92, issue 4, pp. 890-905, April 2011.

-- S. S. Kozat, A. C. Singer, ``Universal semiconstant portfolios,'' Mathematical Finance, vol. 21, no. 2, pp. 293-311, April 2011.

-- S. S. Kozat, A. C. Singer, ``Universal Constant Rebalanced Portfolios with Switching,'' IEEE Int. Conf. on Acoustic Speech and Signal Processing, pp. 1129-1132, April 2007.

-- S. S. Kozat, A. C. Singer, ``Universal Portfolios for Switching and Side-information,'' IEEE Workshop on Machine Learning for Signal Processing, 2006.

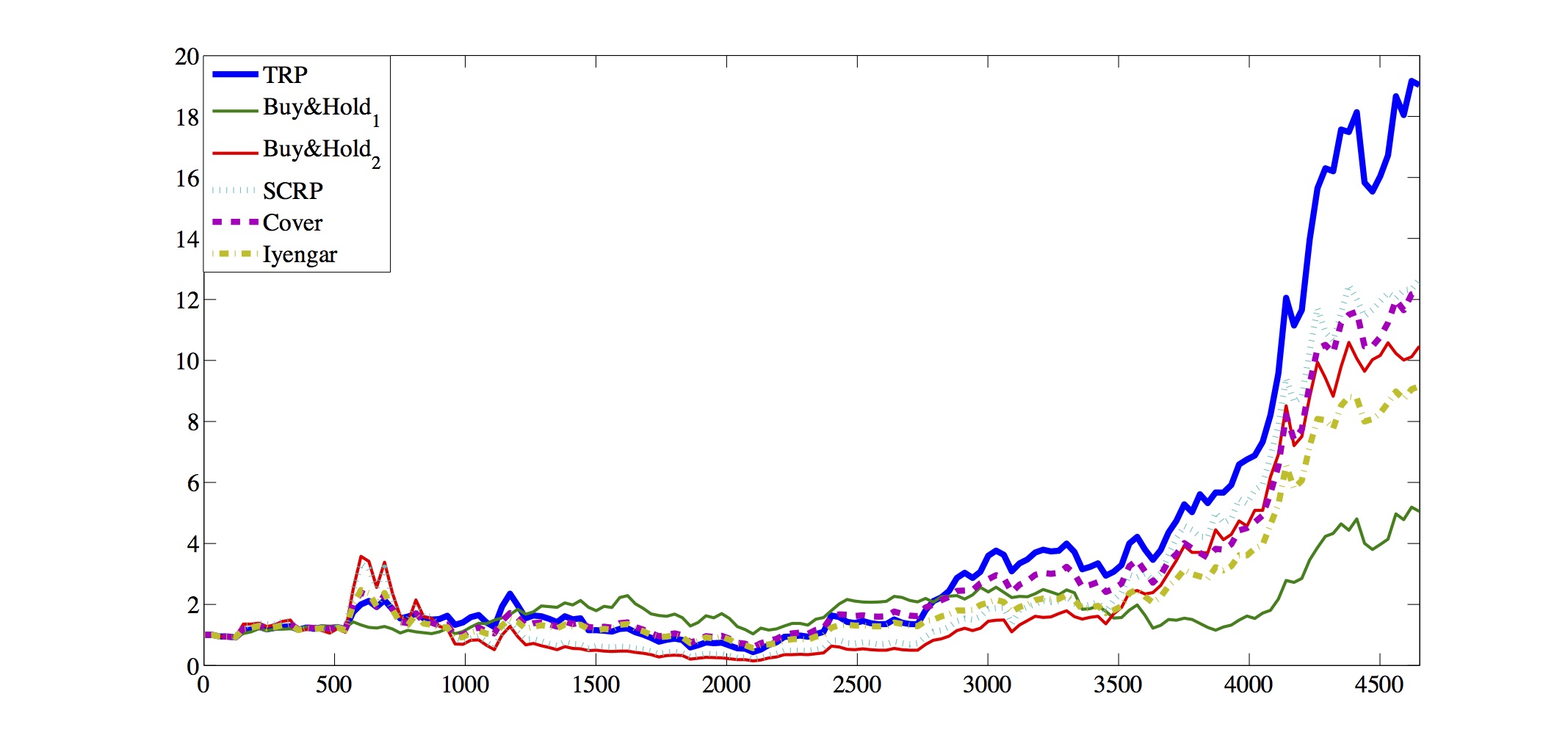

FIGURE: Actual

performance of the introduced algorithms while trading in the New York

Stock Exchange. The details are provided in our

publications.